目前基於Python的量化回測框架有很多,開源框架有zipline、vnpy和backtrader等等,本次以backtrader來示範,

安裝方法可以參考官方網站

簡單的設定

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import backtrader as bt

if __name__ == '__main__':

cerebro = bt.Cerebro()

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

cerebro.run()

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

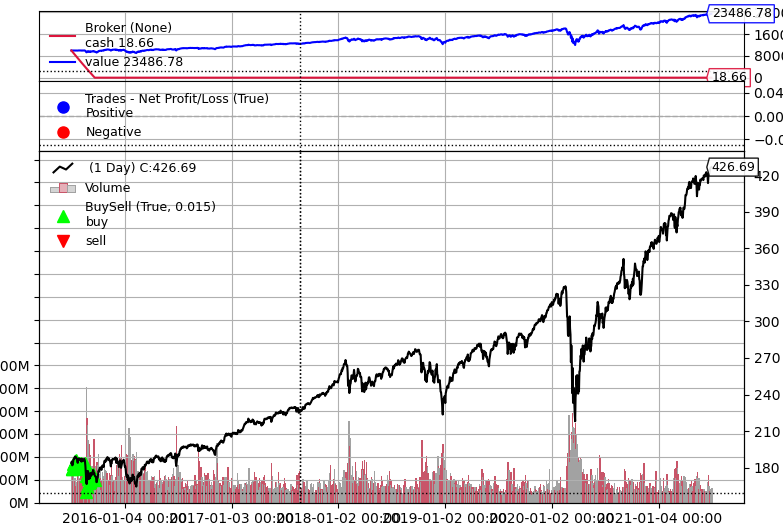

比如說我們要回測SPY狀況

from datetime import datetime

import backtrader as bt

from dateutil.relativedelta import relativedelta

import yfinance as yf

class TestStrategy(bt.Strategy):

def __init__(self):

self._next_buy_date = datetime(2010, 1, 5)

def next(self):

if self.data.datetime.date() >= self. _next_buy_date.date():

self. _next_buy_date += relativedelta(months=1)

self.buy(size=1)

cerebro = bt.Cerebro()

data = bt.feeds.PandasData(dataname=yf.download('SPY', '2015-07-06', '2021-09-23', auto_adjust=True))

cerebro.adddata(data)

cerebro.addstrategy(TestStrategy)

cerebro.broker.set_cash(cash=10000)

cerebro.run()

cerebro.plot()